International Trade Success Starts Here

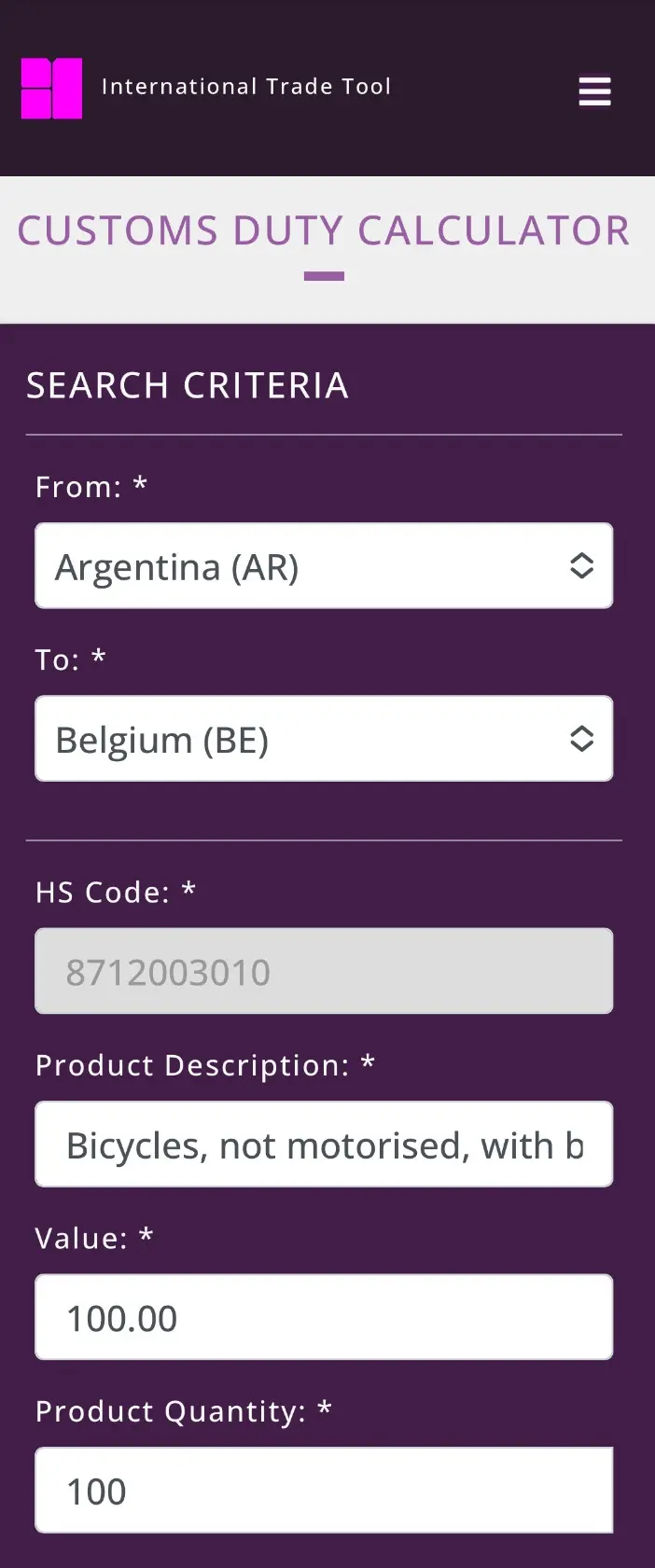

Duty Calculator

The Duty Calculator helps calculate import duties and taxes for over 135 countries, including costs like shipping and insurance, to give accurate landed costs.

It can handle import charges for up to 99 products in one shipment.

A free trial is available to see how it benefits businesses.

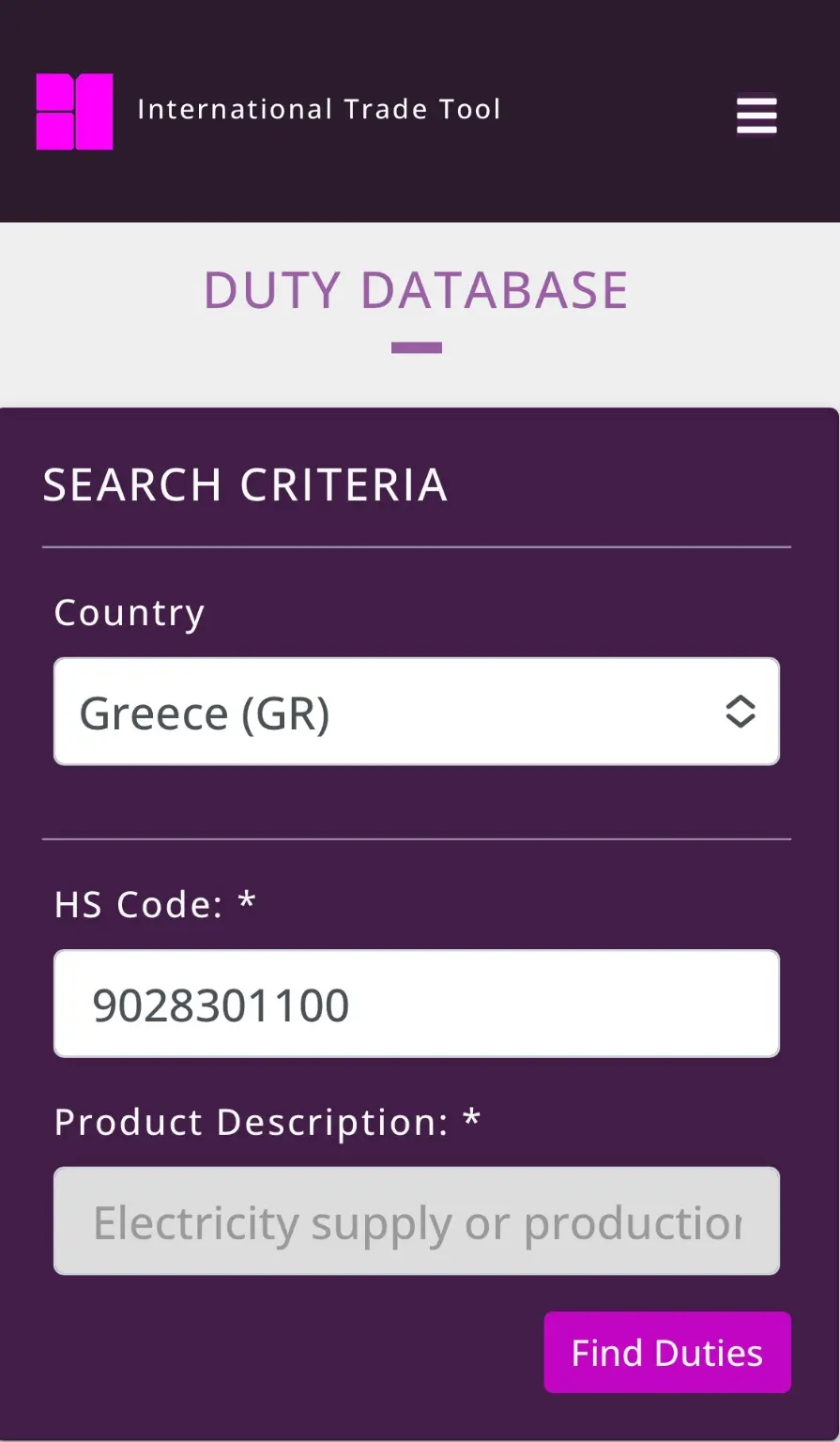

Duty Database

The Duty Database displays import duties for products in different countries' tariffs, allowing users to compare descriptions and find more suitable codes.

Only the first 6 digits of a tariff code are consistent globally, as variations can occur in different countries tariffs a er this point.

This knowledge helps reduce import costs and improve competitiveness in export markets.

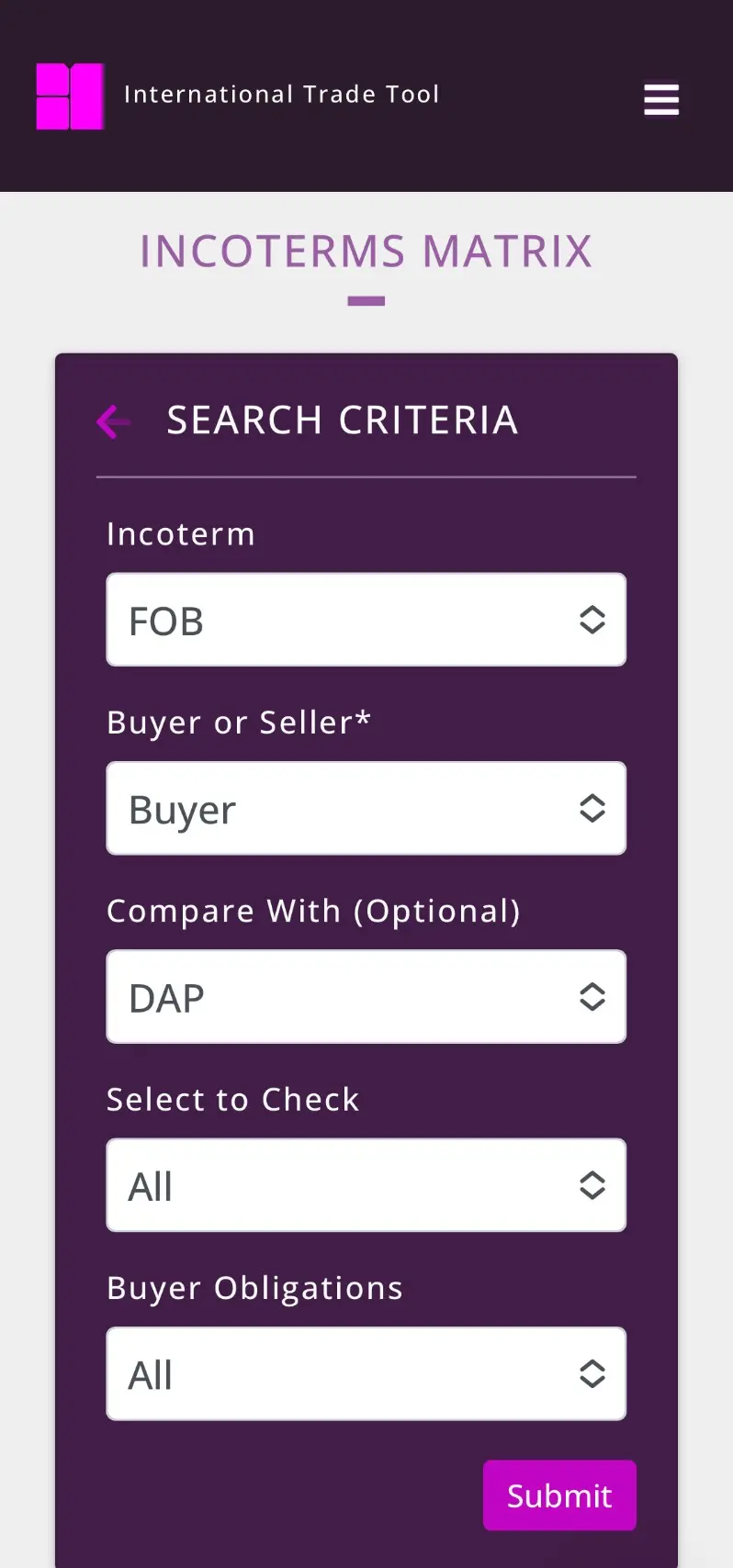

Incoterms

The Incoterms tool provides information on how to choose the best Incoterm for shipments, understand the obligations for each term, and compare the risk and cost responsibilities for both buyers and sellers.

There is a comparison feature to check the obligations of different incoterms.

Understanding the responsibilities of your customer or supplier will help resolve any shipment issues much more efficiently.

Country Information

Understanding international trading differences is crucial for businesses as it affects costs, benefits, and risks.

Key factors include customs procedures, import charges, and product standards.

Access to country information can help with customs compliance requirements, ensuring cost savings and smoother import processes.

This information will help you trade with different countries more successfully.

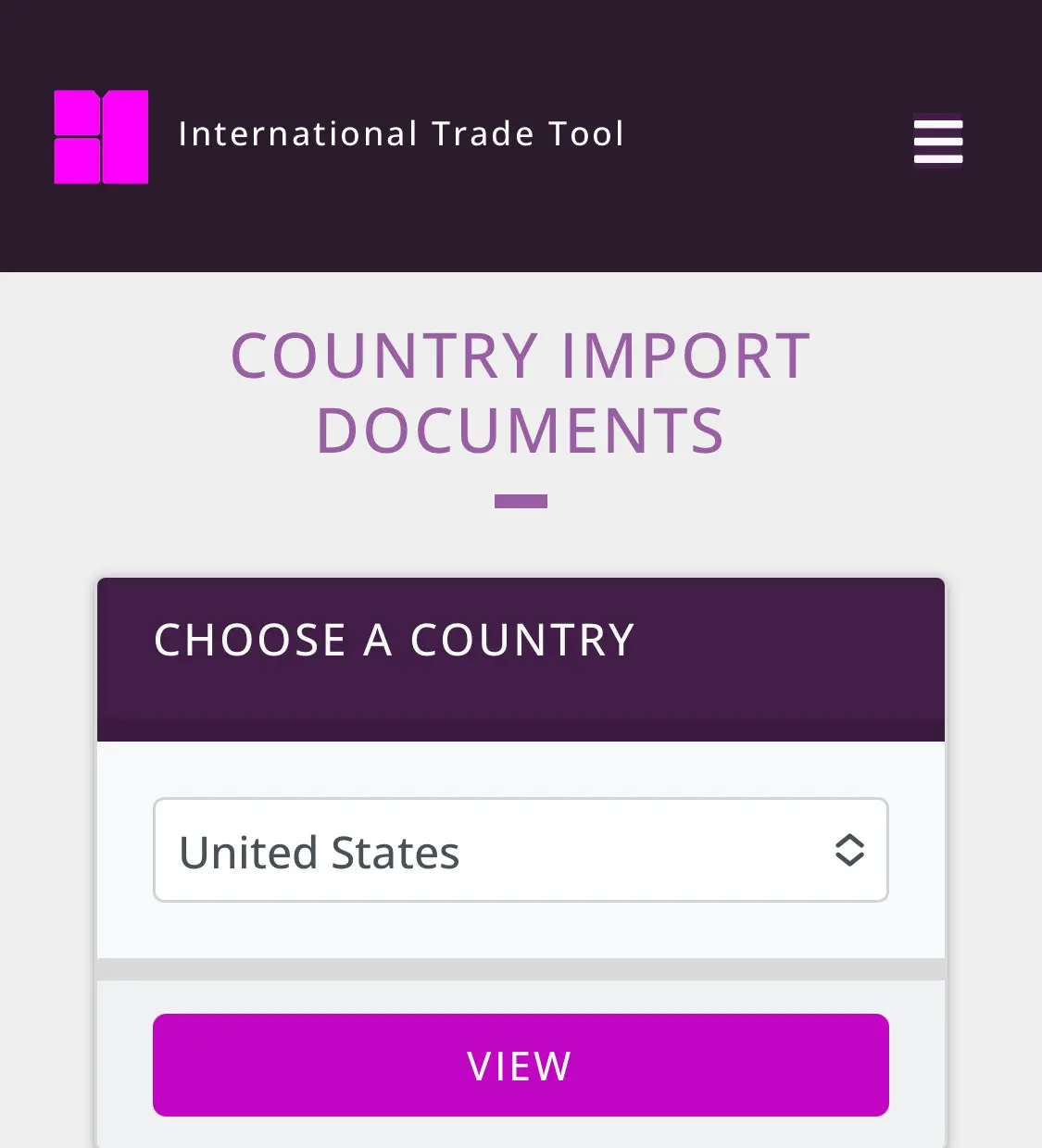

Import Documents

Find out about the many types of international trade documents you may need.

Check where a selected country has trade agreements.

This information can help exporters be more competitive, as these agreements can reduce import duties.

You can also download sample documents and guidelines where applicable.